|

Click each process

for more information...

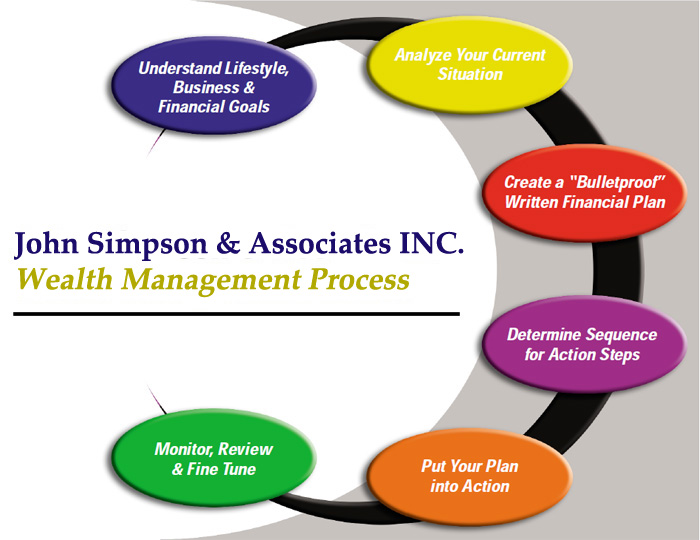

The Wealth Management

Process

Step

#1: Understanding Lifestyle, Business

& Financial Goals

This is

probably the most important stage in the process. This stages

allows me as your Advisor to determine where you stand today from

a financial standpoint. At this point we would discuss your financial

goals and take a look at your current financial situation.

top

Step

#2: Analyze Your Current Situation

After reviewing

your current situation I would then determine whether you are

on track to achieving your financial goals.

top

Step

#3: Creating a "Bulletproof"

Written Financial Plan

The Written

Financial Plan will basically map out the road to achieving the

clients financial goals whether that be Retirement, children's

education, paying off debts or a combination of all three along

with setting up the appropriate amount and type of insurance coverage

that would be required to protect the family in the future. In

the Financial Plan, using realistic numbers, I am able to show

clients exactly what they need to do to get to where they want

to go. That simple yet very effective strategy allows people to

feel comfortable knowing that they are doing everything they need

to do to get to where they want to go. It provides comfort to

people knowing that they are on track to achieving their financial

goals. If you do not have a Written Financial Plan, the saying

"if you fail to plan you plan to fail" says it all.

top

Step

# 4: Determine Sequence for Action

Steps

This is

the stage in the process, where I work with the clients to determine

what will be the sequence of steps. It does vary from client to

client and it does vary depending on the available income that

we have to work with. Ultimately completing all steps in the financial

plan is our end target.

top

Step

#5: Put Your Plan into Action

Putting

the plan into action is really the final step in the process.

This involves getting the client to come into the office to go

through the specific details for the investment process. This

would involve investment decisions and what type of insurance

needs are required. This stage generally includes paperwork, which

would include filling out an Asset Allocation questionnaire, which

will help me to determine clients' comfort level when it comes

to investing.

top

Step

#6: Monitor, Review & Fine Tune

This stage

is basically a maintenance stage...one could use the analogy of

a Dentist. My assistant would at this point book the client in

every six months to do a complete review of their financial situation.

This allows us to keep on top of the changes that may occur. In

today's market place it is important to stay on top of the current

Market Situations to determine how this may or may not affect

the clients financial goals.

top

|